Victoria

Search for more development sites in Victoria here.

CHAPEL STREET - $10.35 million (total)

Two retail properties at opposing ends of Chapel Street have sold for a combined total of over $10 million to local investors.

The first property, located at 521-525 Chapel Street in South Yarra, comprises a two-storey building on a 492sqm landholding and was sold for $7.1 million.

The second property, located at 100 Chapel Street in Windsor, was also a two-storey building, on a smaller 180sqm lot; selling $3.25 million.

Teska Carson's Michael Ludski handled both transactions.

CAMBERWELL – $4.65 million

More retail sales continued, this time with three shops selling in a line to a local investor for a $4.65 million total.

The shops, at 509-513 Riversdale Road, Camberwell, are currently leased to a newsagent and independent retailer and encompass 537sqm of combined floor area.

CBRE's Rorey James, Nic Hage, JJ Heng and Mark Wizel handled the sale.

FITZROY - $2.5 million

A local investor has secured ownership of a Fitzroy retail property, currently leased to a formal suit hire and tailoring business, for $2.5 million. The inner-north heritage building encompasses 541sqm and sits on a 790sqm block at 218-222 Nicholson Street.

CBRE’s Rorey James, JJ Heng, Ashley McIntyre and Nic Hage managed the sale.

BRUNSWICK EAST - $2.4 million

A two-storey warehouse at 368 Lygon Street, Brunswick East in Melbourne’s inner-north has sold to a private investor for $2.4 million.

The 595sqm property was sold with approved plans and permits for the construction of a mixed-use project featuring ground floor retail and more than seven levels of apartments.

Knight Frank’s Stephen Kelly and James Thorpe managed the sale in conjunction with S8 Property’s Anthony Cementon and Michael Cementon.

New South Wales

Search for more development sites in New South Wales here.

CROWS NEST - $11 million

A 1,028sqm property at 2-4 Clarke Street in Sydney’s Crows Nest has sold for $11 million.

The 556sqm two-storey retail and office building drew significant attention during the sales campaign as it is next to the new future Crows Nest metro station.

CBRE’s Nick Heaton and Toby Silk handled the negotiations.

THORNTON - $2.45 million

A 4,434sqm office/warehouse facility at 62 Bonville Avenue, Thornton has been picked up by a Sydney-based investor for $2.45 million.

The NSW central coast property retains its current lease to equipment rental business Nishio until 2025, with options until 2035.

Burgess Rawson’s Kieran Bourke brokered the deal.

Queensland

Search for more development sites in Queensland here.

FLAGSTONE - $20.5 million

Brisbane-based developer Wild Mint Properties, has sold one of Brisbane’s newest shopping centres, Flagstone Village, to a private offshore family for approximately $20.5 million. This is not the new owner’s first Australian investment.

Flagstone Village is a brand-new integrated retail precinct, comprising a total NLA of 2,857sqm over three allotments. The complex is anchored by leading national retailers, including 7-Eleven, IGA, BWS, Terry White Chemmart, Snap Fitness and Domino’s Pizza – generating a net annual income of $1.41 million.

CBRE’s Queensland Retail Investments’ Michael Hedger and Joe Tynan negotiated the sale.

MANGO HILL - $3.92 million

A vacant retail site within the Capstone Estate in Mango Hill, just north of the Brisbane CBD, has sold to a private developer for just under $4 million.

The 1.2-hectare site at 1370 Capestone Boulevard was sold with a permit for a 4,646sqm shopping centre. The developer has announced plans to also construct a medical building and a food and beverage precinct near the supermarket.

Savills Australia's Peter Tyson and Michael Harcourt were responsible for the sale.

ROCKLEA - $3.65 million

A 3,400sqm industrial freestander in Rocklea has transacted for $3.65 million to Mylrea Family Holdings Pty Ltd, who have already announced plans to develop the site in the “near future”.

Located at 1644 Ipswich Road, the property features 3,400sqm of office and warehouse space, 4,000sqm of hardstand area, 3-phase power, staff and customer parking, holding income plus huge exposure to the Ipswich Motorway.

Jack Barrett of Savills said that, “the purchasers had been looking around for quite some time” and saw great potential to redevelop this site due to the 32% site cover and prominent Ipswich Road position.

The property was sold through an off-market campaign handled by Mr Barrett.

Western Australia

Search for more development sites in Western Australia here.

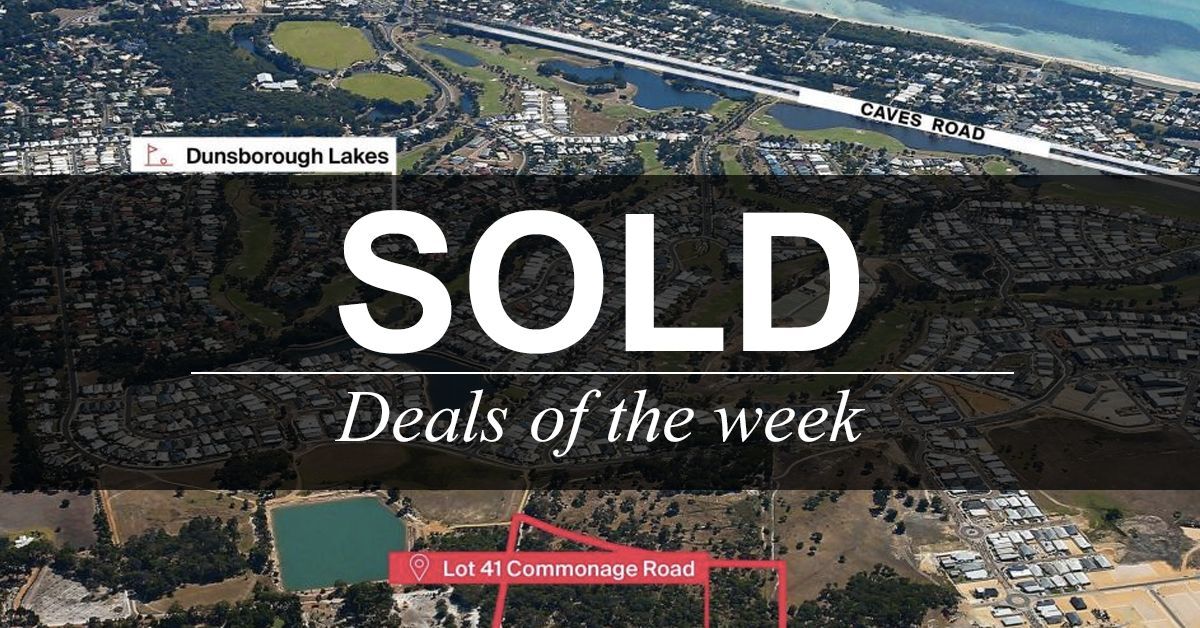

DUNNSBOROUGH - $4.2 million

A 12.55 Hectare residentially zoned site, at Lot 41 Commonage Road, Dunsborough, has been sold for just over $4 million.

The property was marketed with potential for approximately 102 lots and sits adjacent to Dunsborough Lakes Estate. Around 4.68 hectares is said to be reserved for Public Open Space and Habitat Protection.

Todd Schaffer and Tony Delich from Knight Frank managed the sale.

South Australia

Search for more development sites in South Australia.

ADELAIDE - $82.25 million

Charter Hall recently added a central Adelaide asset to their already $1 billion South Australian portfolio, purchasing 121 King William Street from private equity group Blackstone for $82.25 million.

The 13-level, A-Grade tower comprises 12,400sqm of GFA with floors generally spanning across at least 1,000sqm. The sale will also see the retention of major tenants Ernst & Young and Jacobs Engineering Group.

This sale, the largest commercial deal of 2019 thus far, was handled off-market.