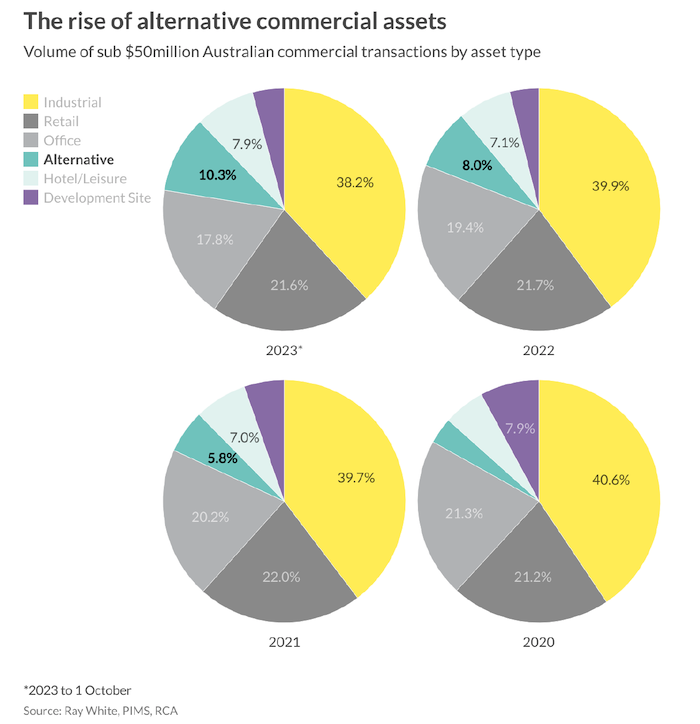

Increased interest rates and geopolitical risks have now added to uncertainty across the broader market, which will likely result in subdued activity into the new year. While financing has been a major issue for most buyers, the private investor market has been the most active, notably in the sub $50 million price range. Industrial has been the golden child of the last few years, accounting for the lion’s share of total commercial volumes, averaging 39.6 per cent over the past four years. During this time we have seen some asset types’ interest dwindle, while others have surged in popularity.

Despite the changing volumes peaking in 2021, the share of investment activity by asset class has remained relatively stable. For the first nine months of this year we have recorded over $19 billion in transactions in the sub $50 million price range, well behind last year's $45.7 billion and peak results of $53.3 billion.

Interest in the office sector has shown consistent decline year on year. During 2020 it accounted for 21.3 per cent of all sales, however, the greatest fall has been felt in the last year to 17.8 per cent in 2023. Sentiment shift across the office asset class has been strong given the rapid rise in vacancies due to the changing nature of workplaces in a post-COVID environment. Working from home has had a significant impact on the way in which tenants interact with office assets, many reducing their footprint or seeking out alternatives putting pressure on occupancy, rents as well as values.

Similarly, the development site space has seen some consolidation due to the rapid escalation in construction costs and labour shortages. While only representing a small portion of the market, we continue to see these assets becoming more difficult to “stack up” despite pressures to develop various asset classes given the recent gains in population across the country. This year, development site sales represented 4.2 per cent. after recording 7.9 per cent in 2020.

Moving quickly in the opposite direction has been the broadly termed “alternatives” space, which includes assets such as childcare, medical, and service stations. These assets have been growing in popularity over the past ten years, and their attractiveness has not wavered during this time of elevated finance cost. This year, these assets represented 10.3 per cent of all of the sub $50 million commercial investment, compared to 3.5 per cent in 2020. Investment yields for these assets continue to trade at competitive rates given their expected growing income stream during a time where the built form is king given replacement costs.

Within the alternatives segment, the largest growth area has been in medical assets. Our increased needs across all age groups, coupled with robust population improvements, is growing requirements for these assets. Similarly, childcare continues to increase, buoyed by government subsidies, notably in key growth nodes across the country. Despite the threat of electric vehicles, service stations remain in demand, particularly those with future upside potential. Challenges across the housing market have also seen a resurgence in enquiry around “block of unit” investments, capitalising on rising rents, low vacancies, and continued capital appreciation, which has now extended into boarding houses and the build-to-rent space.

The variety of investments are vast - car parking and storage assets offer inexpensive opportunities to diversify many investors portfolios. Hotel and leisure assets have also grown their share of volume, with caravan parks a land banking opportunity by opportunistic investors. The chase to secure these assets has been faster and more active than traditional commercial investment options, which raises the question of: what’s next? Perhaps the humble car wash might be the next one, with limited investment needed into the built form, and as vehicle sales continue to grow in line with our population gains; these could offer both a stable income with strong future development upside.

Author: Vanessa Rader, Head of Research, Ray White Corporate