While Australia’s non-bank lenders and private financiers have a strong appetite for commercial real estate (CRE), banks still have the lion’s share of the market. Approximately 90% of all CRE debt, or $381 billion, is provided by the banks, with the remainder provided by a growing number of smaller financiers and non-bank lenders.

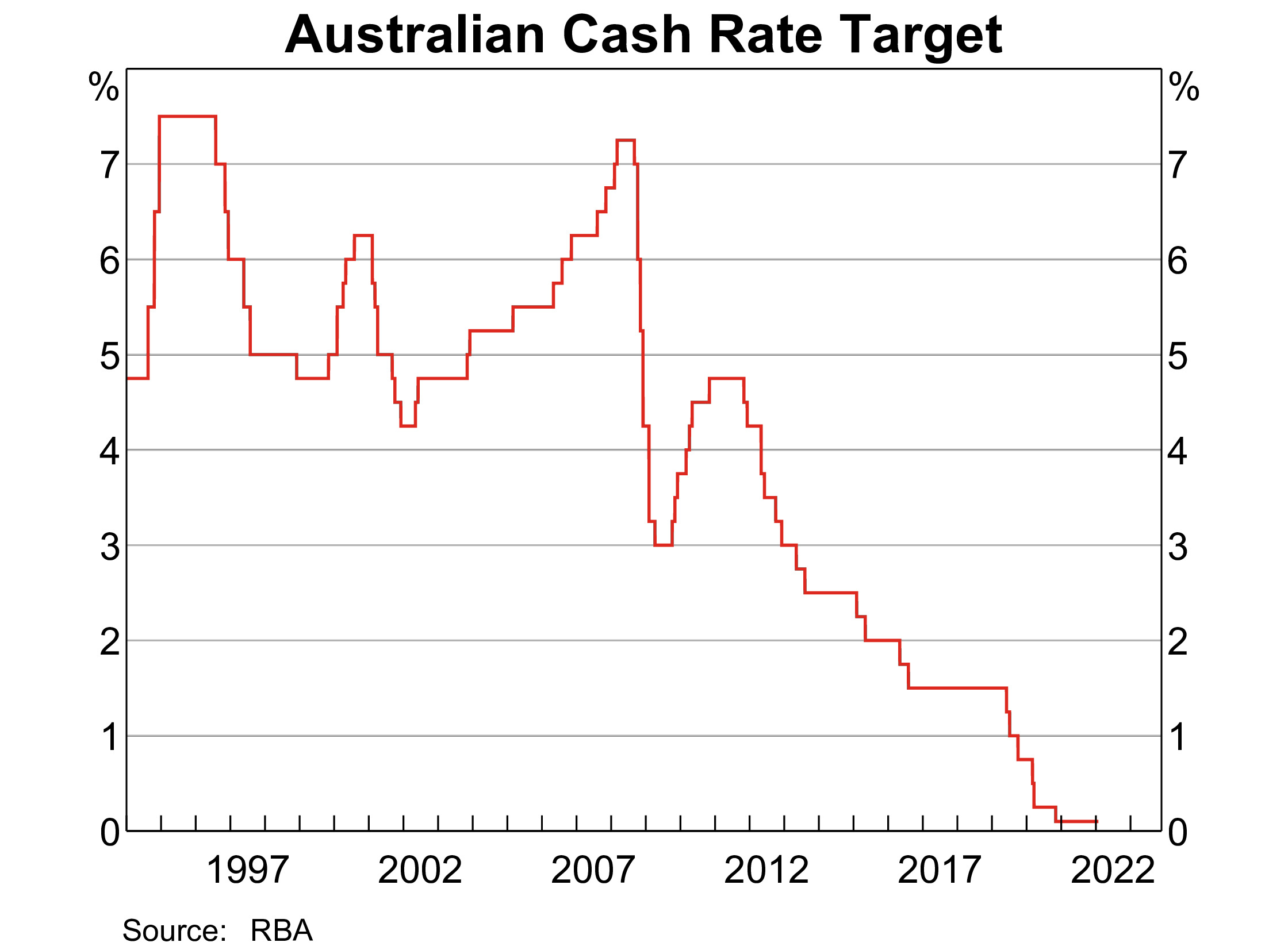

Bank funding costs declined to historical lows in 2020, reflecting the monetary policy measures announced by the Reserve Bank. In aggregate, lending rates have fallen in line with banks' borrowing costs.

For example, in 2020 the cash rate declined from 75 basis points in February to 10 basis points in December, which led to significant reductions in the Bank Bill Swap Rate (BBSW). The BBSW is an important benchmark linked to the deposit and wholesale debt costs of Australia’s major banks.

Non-banks do not secure funding at the same rates as banks, instead relying on alternative sources of wholesale debt, such as the securitisation market.

But as any developer knows, pricing is just one factor when it comes to securing finance for a project. There are many other variables that can make or break a deal.

For construction loans, Wefund works with some banks that will lend up to 65% of a project’s net realisable value and are happy to fund up to 80% of total development costs. With all up rates (inclusive of line fees, margin and establishment fees) as low as 4.5%. For commercial property, investment loans can start from as low as 1.5% with one to five-year interest only periods and rise to 70% of the value of the underlying asset.

For residential construction finance, the banks will want to see a minimum of 80% of net debt covered by pre-sales and a qualified consultant team and reputable builder. The good news is that there are now some banks only requiring 70% of debt cover. Important factors to consider include the viability of the development, its profitability, the capital structure and legal arrangements of the borrowing entity and the security structure generally.

Developers can find out if they qualify for bank funding by using the Wefund platform, which uses a dynamic application process that provides prospective borrowers with data-enabled insights in real time. Within minutes developers can see how many lenders are likely to fund their specific project.

This data-enabled function is an industry first and provides Australian real estate professionals with the confidence that their application will be approved even before it has been submitted.

Our strong relationships with lenders are our key to providing the easiest and best way of securing commercial real estate finance. Submit a scenario today via our website www.wefund.com.au and experience the difference.